Time to buy a house. No Money for Down Payment. No Problem.

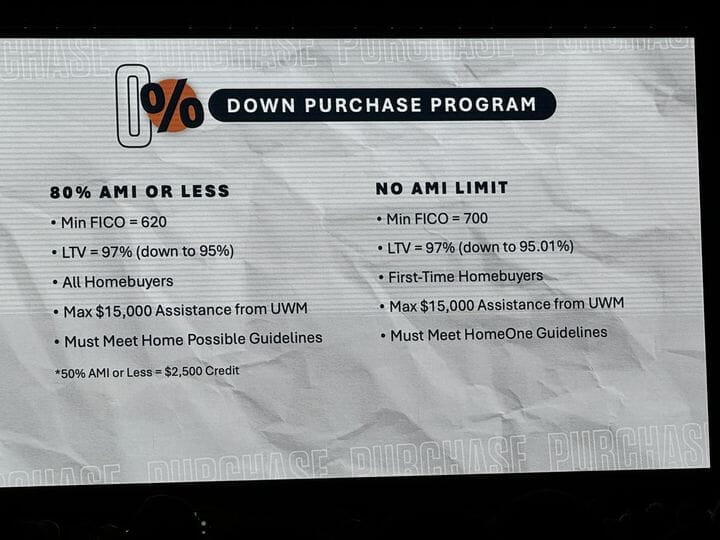

Simply put, qualified borrowers receive a 3% down payment assistance loan, up to $15,000. This allows you to get into a home right now with no down payment.

Here's how it works:

- First lien mortgage meets LTV requirements

- A second lien mortgage for 3% of the purchase price is provided, up to $15,000

- Second lien has no monthly payment requirement and no interest

- Second lien balance is due when the first lien loan is refinanced or paid off, whichever comes first

- Payments on the second lien can be made throughout the loan term, but are not required

- At least one borrower must be a first-time homebuyer and meet HomeOne® and UW’s guideline requirements

- First-time homebuyer is defined as someone who has not had ownership interest in a home in the last 3 years

- 700+ FICO and LTV must be greater than 95%, up to 97%

0% Down Purchase is a down payment assistance program that allows borrowers to receive a 3% loan up to $15,000. Borrowers will have no required monthly payment on the second lien and the second lien does not accrue interest. The second lien is due in full as a balloon payment upon refinance of the 1st lien, a payoff or the final payment of the amortization schedule of the 1st lien.

Benefits

- Allows you to get into a home quicker without a down payment.

- Allows you to use additional funds for home repairs or emergency savings.

- These loans follow either Home Possible® or HomeOne® guidelines, so they can take advantage of LLPA caps. The caps make it easier for underserved borrowers to achieve homeownership. Call Pilot Mortgage to discuss: 480-573-6913.

- This program can help borrowers, real estate agents and mortgage originators by offering an additional affordability product.